Connecting Data to Wealth Creation

Connecting Data to Wealth Creation

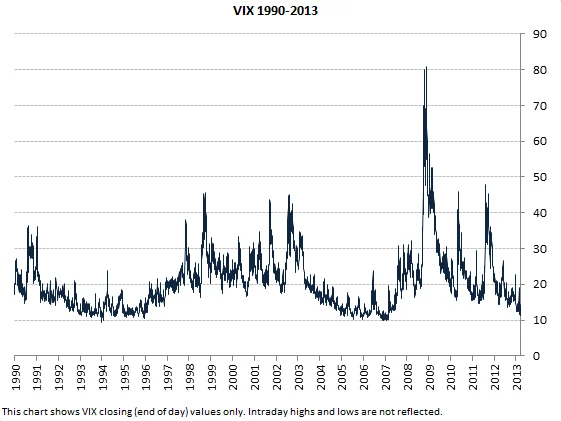

Alright, let's get one thing straight: "Extreme fear" in the stock market? Give me a break. The CNN Fear and Greed Index is flashing red, the VIX is up 15%, and everyone's running around like Chicken Little. Newsflash: this is just Tuesday for anyone who's been paying attention for, oh, the last decade.

So, what's got everyone's panties in a twist this time? The S&P 500 ETF (SPY) and Nasdaq 100 ETF (QQQ) both tanked over 1.5% on Thursday. Why? "Economic uncertainty" – that's the official line, anyway. Post-shutdown optimism fading? Please. It's always something. One minute, we're all gonna be rich, the next, the sky is falling.

The real joke is the delayed economic data. The Labor Department might get September's jobs report out next week, but October's unemployment rate is MIA. October's CPI and jobless claims? Vanished into thin air. White House Press Secretary Karoline Leavitt is even blaming the Democrats for "permanently damaging the federal statistical system." Oh, come on. Is anyone buying this? I mean, seriously?

And then there's the Fed. Higher interest rates to fight inflation. We get it. But they also need to "support maximum employment," which means lower rates. It's like they're trying to drive with one foot on the gas and the other on the brake. No wonder the market's having an existential crisis. How about they get their act together?

The odds of a December rate cut are dropping faster than my faith in humanity. CME's FedWatch tool shows a measly 51.9% chance, down from almost 70% a week ago. Nick Timiraos at the Wall Street Journal says there are "four Fed presidents…who are not actively agitating for a December rate cut (to put it mildly)." Well, ain't that just great?

Speaking of jobs, Challenger, Gray & Christmas reported over 153,000 job cuts in October. That's the highest number since 2003. But hey, don't worry, everything's fine!

I saw some dumb article about William Levy's new movie. What the hell does that have to do with the market? Oh, it was filmed in Spain. Good for him. ViX Premieres Bajo Un Volcán, William Levy’s First Feature Film Shot in Spain.

Here's the thing: markets are like toddlers throwing tantrums. They overreact to everything. A little bad news, and suddenly it's the end of the world. A little good news, and we're all partying like it's 1999. The S&P 500 (SPX) closed down 1.66%, and the Nasdaq 100 (NDX) fell by 2.05%. Okay, sure, its a bad day, but that's nothing new. Stock Market News Review: SPY, QQQ Slump on Economic Data Disruption as VIX Surges 15%

What really pisses me off is the illusion that any of this is predictable or controllable. We're all just guessing, throwing darts at a board, pretending we know what's going on. The "experts" are just as clueless as the rest of us. They make fancy predictions and use complicated jargon, but at the end of the day, it's all just noise. I mean, offcourse they get some things right, but so does a broken clock...

I'm not saying you should ignore the market. But don't get sucked into the hysteria. "Extreme fear" is just a marketing term. It's designed to get your attention, to make you click on articles, to make you trade more. Don't fall for it.

So, what's the real story? It's the same story it always is: volatility, uncertainty, and a healthy dose of BS. The market will go up, the market will go down, and the talking heads will keep talking. Just remember to take it all with a grain of salt. And maybe a shot of whiskey.