Connecting Data to Wealth Creation

Connecting Data to Wealth Creation

Okay, folks, buckle up, because the IRS just dropped some news that should have every single one of us rethinking our retirement strategies. I'm talking about the freshly announced 401(k) and IRA contribution limits for 2026. And let me tell you, these aren't just minor tweaks; they're a serious invitation to supercharge your savings and build a retirement nest egg that can truly set you free.

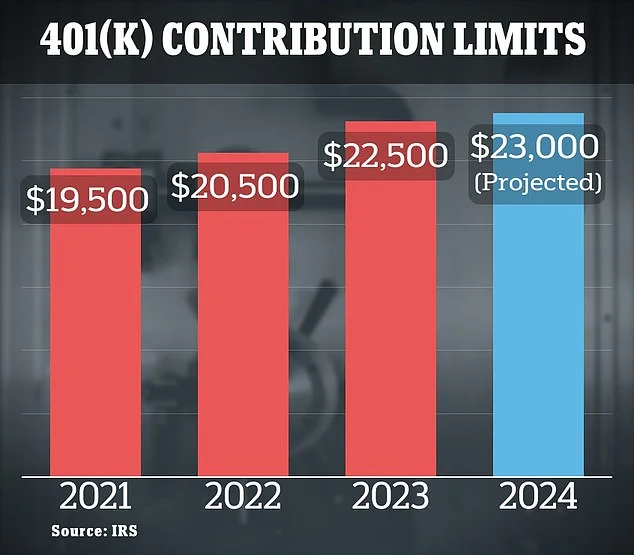

The headline? You'll be able to sock away even more cash, tax-advantaged, into your future. The annual contribution limit for 401(k)s jumps to $24,500, a full grand more than last year. And for IRAs, we're looking at a bump to $7,500. But, honestly, it's not just about the numbers themselves—it's about what these numbers represent. It’s about the potential they unlock. It’s about the agency they give you over your future.

But here's where things get really interesting. Remember the SECURE 2.0 Act? This isn’t just a passive increase based on inflation; it's an active push to get people saving more, especially those nearing retirement. The "catch-up" contributions for those 50 and older are getting a boost, too, giving you even more firepower to catch up if you started saving later in life.

And for those aged 60-63? Hold onto your hats! The "super catch-up" provision lets you contribute even more. We're talking about a potential total contribution of $32,500 for qualifying DC plans and a whopping $11,250 catch-up contribution for those in that 60-63 age bracket. It's like the government is practically begging us to secure our futures!

This isn't just about individual accounts, either. The income eligibility ranges for IRAs and the Saver's Credit are also being adjusted, meaning more people than ever before will be able to take advantage of these tax-saving opportunities. Think of it like this: the government is widening the on-ramp to the highway of financial security, making it accessible to a broader range of drivers. I think this is a great move to help more people get to the finish line.

When I first saw these numbers, honestly, I felt a surge of optimism. We live in a world that often feels uncertain, where the future can seem daunting. But these increased contribution limits? They're a tangible reminder that we have the power to shape our own destinies.

But, with every opportunity comes responsibility. As we gain more control over our financial futures, we must also be mindful of the ethical considerations involved. Are we saving responsibly, considering the impact of our investments on the world around us? Are we ensuring that our financial gains don't come at the expense of others? These are questions we must ask ourselves as we navigate this new landscape.

Now, I know what some of you might be thinking: "Okay, Dr. Thorne, this all sounds great, but what does it really mean for me?" Well, imagine this: you're 35 years old, just starting to hit your stride in your career. By maxing out your 401(k) contributions each year, taking full advantage of these new limits, you could be adding hundreds of thousands of dollars to your retirement savings over the next few decades. That's the difference between a comfortable retirement and a luxurious one.

And let's not forget the power of compounding. As Albert Einstein famously said, "Compound interest is the eighth wonder of the world. He who understands it, earns it… he who doesn't… pays it." By starting early and consistently contributing, you're harnessing the power of compounding to grow your wealth exponentially. It’s like planting a tiny seed that blossoms into a giant tree over time, providing shade and security for years to come. But are we doing enough to educate younger generations about this?

The IRS is giving us the tools; it's up to us to use them wisely. So, take a look at your budget, reassess your financial goals, and start planning for 2026 today. Your future self will thank you for it.